base module¶

Base class for modeling portfolio and measuring its performance.

Provides the class Portfolio for modeling portfolio performance and calculating various risk and performance metrics. It uses Numba-compiled functions from vectorbt.portfolio.nb for most computations and record classes based on Records for evaluating events such as orders, logs, trades, positions, and drawdowns.

The job of the Portfolio class is to create a series of positions allocated against a cash component, produce an equity curve, incorporate basic transaction costs and produce a set of statistics about its performance. In particular, it outputs position/profit metrics and drawdown information.

Run for the examples below:

>>> import numpy as np

>>> import pandas as pd

>>> from datetime import datetime

>>> import talib

>>> from numba import njit

>>> import vectorbt as vbt

>>> from vectorbt.utils.colors import adjust_opacity

>>> from vectorbt.utils.enum_ import map_enum_fields

>>> from vectorbt.base.reshape_fns import broadcast, flex_select_auto_nb, to_2d_array

>>> from vectorbt.portfolio.enums import SizeType, Direction, NoOrder, OrderStatus, OrderSide

>>> from vectorbt.portfolio import nb

Workflow¶

Portfolio class does quite a few things to simulate your strategy.

Preparation phase (in the particular class method):

- Receives a set of inputs, such as signal arrays and other parameters

- Resolves parameter defaults by searching for them in the global settings

- Brings input arrays to a single shape

- Does some basic validation of inputs and converts Pandas objects to NumPy arrays

- Passes everything to a Numba-compiled simulation function

Simulation phase (in the particular simulation function using Numba):

- The simulation function traverses the broadcasted shape element by element, row by row (time dimension), column by column (asset dimension)

- For each asset and timestamp (= element):

- Gets all available information related to this element and executes the logic

- Generates an order or skips the element altogether

- If an order has been issued, processes the order and fills/ignores/rejects it

- If the order has been filled, registers the result by appending it to the order records

- Updates the current state such as the cash and asset balances

Construction phase (in the particular class method):

- Receives the returned order records and initializes a new Portfolio object

Analysis phase (in the Portfolio object)

- Offers a broad range of risk & performance metrics based on order records

Simulation modes¶

There are three main simulation modes.

From orders¶

Portfolio.from_orders() is the most straightforward and the fastest out of all simulation modes.

An order is a simple instruction that contains size, price, fees, and other information (see Order for details about what information a typical order requires). Instead of creating a Order tuple for each asset and timestamp (which may waste a lot of memory) and appending it to a (potentially huge) list for processing, Portfolio.from_orders() takes each of those information pieces as an array, broadcasts them against each other, and creates a Order tuple out of each element for us.

Thanks to broadcasting, we can pass any of the information as a 2-dim array, as a 1-dim array per column or row, and as a constant. And we don't even need to provide every piece of information - vectorbt fills the missing data with default constants, without wasting memory.

Here's an example:

>>> size = pd.Series([1, -1, 1, -1]) # per row

>>> price = pd.DataFrame({'a': [1, 2, 3, 4], 'b': [4, 3, 2, 1]}) # per element

>>> direction = ['longonly', 'shortonly'] # per column

>>> fees = 0.01 # per frame

>>> pf = vbt.Portfolio.from_orders(price, size, direction=direction, fees=fees)

>>> pf.orders.records_readable

Order Id Column Timestamp Size Price Fees Side

0 0 a 0 1.0 1.0 0.01 Buy

1 1 a 1 1.0 2.0 0.02 Sell

2 2 a 2 1.0 3.0 0.03 Buy

3 3 a 3 1.0 4.0 0.04 Sell

4 4 b 0 1.0 4.0 0.04 Sell

5 5 b 1 1.0 3.0 0.03 Buy

6 6 b 2 1.0 2.0 0.02 Sell

7 7 b 3 1.0 1.0 0.01 Buy

This method is particularly useful in situations where you don't need any further logic apart from filling orders at predefined timestamps. If you want to issue orders depending upon the previous performance, the current state, or other custom conditions, head over to Portfolio.from_signals() or Portfolio.from_order_func().

From signals¶

Portfolio.from_signals() is centered around signals. It adds an abstraction layer on top of Portfolio.from_orders() to automate some signaling processes. For example, by default, it won't let us execute another entry signal if we are already in the position. It also implements stop loss and take profit orders for exiting positions. Nevertheless, this method behaves similarly to Portfolio.from_orders() and accepts most of its arguments; in fact, by setting accumulate=True, it behaves quite similarly to Portfolio.from_orders().

Let's replicate the example above using signals:

>>> entries = pd.Series([True, False, True, False])

>>> exits = pd.Series([False, True, False, True])

>>> pf = vbt.Portfolio.from_signals(price, entries, exits, size=1, direction=direction, fees=fees)

>>> pf.orders.records_readable

Order Id Column Timestamp Size Price Fees Side

0 0 a 0 1.0 1.0 0.01 Buy

1 1 a 1 1.0 2.0 0.02 Sell

2 2 a 2 1.0 3.0 0.03 Buy

3 3 a 3 1.0 4.0 0.04 Sell

4 4 b 0 1.0 4.0 0.04 Sell

5 5 b 1 1.0 3.0 0.03 Buy

6 6 b 2 1.0 2.0 0.02 Sell

7 7 b 3 1.0 1.0 0.01 Buy

In a nutshell: this method automates some procedures that otherwise would be only possible by using Portfolio.from_order_func() while following the same broadcasting principles as Portfolio.from_orders() - the best of both worlds, given you can express your strategy as a sequence of signals. But as soon as your strategy requires any signal to depend upon more complex conditions or to generate multiple orders at once, it's best to run your custom signaling logic using Portfolio.from_order_func().

From order function¶

Portfolio.from_order_func() is the most powerful form of simulation. Instead of pulling information from predefined arrays, it lets us define an arbitrary logic through callbacks. There are multiple kinds of callbacks, each called at some point while the simulation function traverses the shape. For example, apart from the main callback that returns an order (order_func_nb), there is a callback that does preprocessing on the entire group of columns at once. For more details on the general procedure and the callback zoo, see simulate_nb().

Let's replicate our example using an order function:

>>> @njit

>>> def order_func_nb(c, size, direction, fees):

... return nb.order_nb(

... price=c.close[c.i, c.col],

... size=size[c.i],

... direction=direction[c.col],

... fees=fees

... )

>>> direction_num = map_enum_fields(direction, Direction)

>>> pf = vbt.Portfolio.from_order_func(

... price,

... order_func_nb,

... np.asarray(size), np.asarray(direction_num), fees

... )

>>> pf.orders.records_readable

Order Id Column Timestamp Size Price Fees Side

0 0 a 0 1.0 1.0 0.01 Buy

1 1 a 1 1.0 2.0 0.02 Sell

2 2 a 2 1.0 3.0 0.03 Buy

3 3 a 3 1.0 4.0 0.04 Sell

4 4 b 0 1.0 4.0 0.04 Sell

5 5 b 1 1.0 3.0 0.03 Buy

6 6 b 2 1.0 2.0 0.02 Sell

7 7 b 3 1.0 1.0 0.01 Buy

There is an even more flexible version available - flex_simulate_nb() (activated by passing flexible=True to Portfolio.from_order_func()) - that allows creating multiple orders per symbol and bar.

This method has many advantages:

- Realistic simulation as it follows the event-driven approach - less risk of exposure to the look-ahead bias

- Provides a lot of useful information during the runtime, such as the current position's PnL

- Enables putting all logic including custom indicators into a single place, and running it as the data comes in, in a memory-friendly manner

But there are drawbacks too:

- Doesn't broadcast arrays - needs to be done by the user prior to the execution

- Requires at least a basic knowledge of NumPy and Numba

- Requires at least an intermediate knowledge of both to optimize for efficiency

Example¶

To showcase the features of Portfolio, run the following example: it checks candlestick data of 6 major cryptocurrencies in 2020 against every single pattern found in TA-Lib, and translates them into orders.

>>> # Fetch price history

>>> symbols = ['BTC-USD', 'ETH-USD', 'XRP-USD', 'BNB-USD', 'BCH-USD', 'LTC-USD']

>>> start = '2020-01-01 UTC' # crypto is UTC

>>> end = '2020-09-01 UTC'

>>> # OHLCV by column

>>> ohlcv = vbt.YFData.download(symbols, start=start, end=end).concat()

>>> ohlcv['Open']

symbol BTC-USD ETH-USD XRP-USD BNB-USD \

Date

2020-01-01 00:00:00+00:00 7194.892090 129.630661 0.192912 13.730962

2020-01-02 00:00:00+00:00 7202.551270 130.820038 0.192708 13.698126

2020-01-03 00:00:00+00:00 6984.428711 127.411263 0.187948 13.035329

... ... ... ... ...

2020-08-30 00:00:00+00:00 11508.713867 399.616699 0.274568 23.009060

2020-08-31 00:00:00+00:00 11713.306641 428.509003 0.283065 23.647858

2020-09-01 00:00:00+00:00 11679.316406 434.874451 0.281612 23.185047

symbol BCH-USD LTC-USD

Date

2020-01-01 00:00:00+00:00 204.671295 41.326534

2020-01-02 00:00:00+00:00 204.354538 42.018085

2020-01-03 00:00:00+00:00 196.007690 39.863129

... ... ...

2020-08-30 00:00:00+00:00 268.842865 57.207737

2020-08-31 00:00:00+00:00 279.280426 62.844059

2020-09-01 00:00:00+00:00 274.480865 61.105076

[244 rows x 6 columns]

>>> # Run every single pattern recognition indicator and combine the results

>>> result = pd.DataFrame.vbt.empty_like(ohlcv['Open'], fill_value=0.)

>>> for pattern in talib.get_function_groups()['Pattern Recognition']:

... PRecognizer = vbt.IndicatorFactory.from_talib(pattern)

... pr = PRecognizer.run(ohlcv['Open'], ohlcv['High'], ohlcv['Low'], ohlcv['Close'])

... result = result + pr.integer

>>> # Don't look into the future

>>> result = result.vbt.fshift(1)

>>> # Treat each number as order value in USD

>>> size = result / ohlcv['Open']

>>> # Simulate portfolio

>>> pf = vbt.Portfolio.from_orders(

... ohlcv['Close'], size, price=ohlcv['Open'],

... init_cash='autoalign', fees=0.001, slippage=0.001)

>>> # Visualize portfolio value

>>> pf.value().vbt.plot()

Broadcasting¶

Portfolio is very flexible towards inputs:

- Accepts both Series and DataFrames as inputs

- Broadcasts inputs to the same shape using vectorbt's own broadcasting rules

- Many inputs (such as

fees) can be passed as a single value, value per column/row, or as a matrix - Implements flexible indexing wherever possible to save memory

Flexible indexing¶

Instead of expensive broadcasting, most methods keep the original shape and do indexing in a smart way. A nice feature of this is that it has almost no memory footprint and can broadcast in any direction indefinitely.

For example, let's broadcast three inputs and select the last element using both approaches:

>>> # Classic way

>>> a = np.array([1, 2, 3])

>>> b = np.array([[4], [5], [6]])

>>> c = np.array(10)

>>> a_, b_, c_ = broadcast(a, b, c)

>>> a_

array([[1, 2, 3],

[1, 2, 3],

[1, 2, 3]])

>>> a_[2, 2]

3

>>> b_

array([[4, 4, 4],

[5, 5, 5],

[6, 6, 6]])

>>> b_[2, 2]

6

>>> c_

array([[10, 10, 10],

[10, 10, 10],

[10, 10, 10]])

>>> c_[2, 2]

10

>>> # Flexible indexing being done during simulation

>>> flex_select_auto_nb(a, 2, 2)

3

>>> flex_select_auto_nb(b, 2, 2)

6

>>> flex_select_auto_nb(c, 2, 2)

10

Defaults¶

If you look at the arguments of each class method, you will notice that most of them default to None. None has a special meaning in vectorbt: it's a command to pull the default value from the global settings config - settings. The branch for the Portfolio can be found under the key 'portfolio'. For example, the default size used in Portfolio.from_signals() and Portfolio.from_orders() is np.inf:

>>> vbt.settings.portfolio['size']

inf

Grouping¶

One of the key features of Portfolio is the ability to group columns. Groups can be specified by group_by, which can be anything from positions or names of column levels, to a NumPy array with actual groups. Groups can be formed to share capital between columns (make sure to pass cash_sharing=True) or to compute metrics for a combined portfolio of multiple independent columns.

For example, let's divide our portfolio into two groups sharing the same cash balance:

>>> # Simulate combined portfolio

>>> group_by = pd.Index([

... 'first', 'first', 'first',

... 'second', 'second', 'second'

... ], name='group')

>>> comb_pf = vbt.Portfolio.from_orders(

... ohlcv['Close'], size, price=ohlcv['Open'],

... init_cash='autoalign', fees=0.001, slippage=0.001,

... group_by=group_by, cash_sharing=True)

>>> # Get total profit per group

>>> comb_pf.total_profit()

group

first 26221.571200

second 10141.952674

Name: total_profit, dtype: float64

Not only can we analyze each group, but also each column in the group:

>>> # Get total profit per column

>>> comb_pf.total_profit(group_by=False)

symbol

BTC-USD 5792.120252

ETH-USD 16380.039692

XRP-USD 4049.411256

BNB-USD 6081.253551

BCH-USD 400.573418

LTC-USD 3660.125705

Name: total_profit, dtype: float64

In the same way, we can introduce new grouping to the method itself:

>>> # Get total profit per group

>>> pf.total_profit(group_by=group_by)

group

first 26221.571200

second 10141.952674

Name: total_profit, dtype: float64

Note

If cash sharing is enabled, grouping can be disabled but cannot be modified.

Indexing¶

Like any other class subclassing Wrapping, we can do pandas indexing on a Portfolio instance, which forwards indexing operation to each object with columns:

>>> pf['BTC-USD']

<vectorbt.portfolio.base.Portfolio at 0x7fac7517ac88>

>>> pf['BTC-USD'].total_profit()

5792.120252189081

Combined portfolio is indexed by group:

>>> comb_pf['first']

<vectorbt.portfolio.base.Portfolio at 0x7fac5756b828>

>>> comb_pf['first'].total_profit()

26221.57120014546

Note

Changing index (time axis) is not supported. The object should be treated as a Series rather than a DataFrame; for example, use pf.iloc[0] instead of pf.iloc[:, 0].

Indexing behavior depends solely upon ArrayWrapper. For example, if group_select is enabled indexing will be performed on groups, otherwise on single columns. You can pass wrapper arguments with wrapper_kwargs.

Logging¶

To collect more information on how a specific order was processed or to be able to track the whole simulation from the beginning to the end, we can turn on logging:

>>> # Simulate portfolio with logging

>>> pf = vbt.Portfolio.from_orders(

... ohlcv['Close'], size, price=ohlcv['Open'],

... init_cash='autoalign', fees=0.001, slippage=0.001, log=True)

>>> pf.logs.records

id group col idx cash position debt free_cash val_price \

0 0 0 0 0 inf 0.000000 0.0 inf 7194.892090

1 1 0 0 1 inf 0.000000 0.0 inf 7202.551270

2 2 0 0 2 inf 0.000000 0.0 inf 6984.428711

... ... ... ... ... ... ... ... ... ...

1461 1461 5 5 241 inf 272.389644 0.0 inf 57.207737

1462 1462 5 5 242 inf 274.137659 0.0 inf 62.844059

1463 1463 5 5 243 inf 282.093860 0.0 inf 61.105076

value ... new_free_cash new_val_price new_value res_size \

0 inf ... inf 7194.892090 inf NaN

1 inf ... inf 7202.551270 inf NaN

2 inf ... inf 6984.428711 inf NaN

... ... ... ... ... ... ...

1461 inf ... inf 57.207737 inf 1.748015

1462 inf ... inf 62.844059 inf 7.956202

1463 inf ... inf 61.105076 inf 1.636525

res_price res_fees res_side res_status res_status_info order_id

0 NaN NaN -1 1 0 -1

1 NaN NaN -1 1 5 -1

2 NaN NaN -1 1 5 -1

... ... ... ... ... ... ...

1461 57.264945 0.1001 0 0 -1 1070

1462 62.906903 0.5005 0 0 -1 1071

1463 61.043971 0.0999 1 0 -1 1072

[1464 rows x 37 columns]

Just as orders, logs are also records and thus can be easily analyzed:

>>> pf.logs.res_status.value_counts()

symbol BTC-USD ETH-USD XRP-USD BNB-USD BCH-USD LTC-USD

Filled 184 172 177 178 177 185

Ignored 60 72 67 66 67 59

Logging can also be turned on just for one order, row, or column, since as many other variables it's specified per order and can broadcast automatically.

Note

Logging can slow down simulation.

Caching¶

Portfolio heavily relies upon caching. If a method or a property requires heavy computation, it's wrapped with cached_method() and cached_property respectively. Caching can be disabled globally via caching in settings.

Note

Because of caching, class is meant to be immutable and all properties are read-only. To change any attribute, use the copy method and pass the attribute as keyword argument.

Alternatively, we can precisely point at attributes and methods that should or shouldn't be cached. For example, we can blacklist the entire Portfolio class except a few most called methods such as Portfolio.cash_flow() and Portfolio.asset_flow():

>>> vbt.settings.caching['blacklist'].append(

... vbt.CacheCondition(base_cls='Portfolio')

... )

>>> vbt.settings.caching['whitelist'].extend([

... vbt.CacheCondition(base_cls='Portfolio', func='cash_flow'),

... vbt.CacheCondition(base_cls='Portfolio', func='asset_flow')

... ])

Define rules for one instance of Portfolio:

>>> vbt.settings.caching['blacklist'].append(

... vbt.CacheCondition(instance=pf)

... )

>>> vbt.settings.caching['whitelist'].extend([

... vbt.CacheCondition(instance=pf, func='cash_flow'),

... vbt.CacheCondition(instance=pf, func='asset_flow')

... ])

See should_cache() for caching rules.

To reset caching:

>>> vbt.settings.caching.reset()

Performance and memory¶

If you're running out of memory when working with large arrays, make sure to disable caching and then store most important time series manually. For example, if you're interested in Sharpe ratio or other metrics based on returns, run and save Portfolio.returns() in a variable and then use the ReturnsAccessor to analyze them. Do not use methods akin to Portfolio.sharpe_ratio() because they will re-calculate returns each time.

Alternatively, you can track portfolio value and returns using Portfolio.from_order_func() and its callbacks (preferably in post_segment_func_nb):

>>> pf_baseline = vbt.Portfolio.from_orders(

... ohlcv['Close'], size, price=ohlcv['Open'],

... init_cash='autoalign', fees=0.001, slippage=0.001, freq='d')

>>> pf_baseline.sharpe_ratio()

symbol

BTC-USD 1.743437

ETH-USD 2.800903

XRP-USD 1.607904

BNB-USD 1.805373

BCH-USD 0.269392

LTC-USD 1.040494

Name: sharpe_ratio, dtype: float64

>>> @njit

... def order_func_nb(c, size, price, fees, slippage):

... return nb.order_nb(

... size=nb.get_elem_nb(c, size),

... price=nb.get_elem_nb(c, price),

... fees=nb.get_elem_nb(c, fees),

... slippage=nb.get_elem_nb(c, slippage),

... )

>>> @njit

... def post_segment_func_nb(c, returns_out):

... returns_out[c.i, c.group] = c.last_return[c.group]

>>> returns_out = np.empty_like(ohlcv['Close'], dtype=np.float64)

>>> pf = vbt.Portfolio.from_order_func(

... ohlcv['Close'],

... order_func_nb,

... np.asarray(size),

... np.asarray(ohlcv['Open']),

... np.asarray(0.001),

... np.asarray(0.001),

... post_segment_func_nb=post_segment_func_nb,

... post_segment_args=(returns_out,),

... init_cash=pf_baseline.init_cash

... )

>>> returns = pf.wrapper.wrap(returns_out)

>>> del pf

>>> returns.vbt.returns(freq='d').sharpe_ratio()

symbol

BTC-USD -2.261443

ETH-USD 0.059538

XRP-USD 2.159093

BNB-USD 1.555386

BCH-USD 0.784214

LTC-USD 1.460077

Name: sharpe_ratio, dtype: float64

The only drawback of this approach is that you cannot use init_cash='auto' or init_cash='autoalign' because then, during the simulation, the portfolio value is np.inf and the returns are np.nan.

Saving and loading¶

Like any other class subclassing Pickleable, we can save a Portfolio instance to the disk with Pickleable.save() and load it with Pickleable.load():

>>> pf = vbt.Portfolio.from_orders(

... ohlcv['Close'], size, price=ohlcv['Open'],

... init_cash='autoalign', fees=0.001, slippage=0.001, freq='d')

>>> pf.sharpe_ratio()

symbol

BTC-USD 1.743437

ETH-USD 2.800903

XRP-USD 1.607904

BNB-USD 1.805373

BCH-USD 0.269392

LTC-USD 1.040494

Name: sharpe_ratio, dtype: float64

>>> pf.save('my_pf')

>>> pf = vbt.Portfolio.load('my_pf')

>>> pf.sharpe_ratio()

symbol

BTC-USD 1.743437

ETH-USD 2.800903

XRP-USD 1.607904

BNB-USD 1.805373

BCH-USD 0.269392

LTC-USD 1.040494

Name: sharpe_ratio, dtype: float64

Note

Save files won't include neither cached results nor global defaults. For example, passing fillna_close as None will also use None when the portfolio is loaded from disk. Make sure to either pass all arguments explicitly or to also save the settings config.

Stats¶

Hint

Let's simulate a portfolio with two columns:

>>> close = vbt.YFData.download(

... "BTC-USD",

... start='2020-01-01 UTC',

... end='2020-09-01 UTC'

... ).get('Close')

>>> pf = vbt.Portfolio.from_random_signals(close, n=[10, 20], seed=42)

>>> pf.wrapper.columns

Index([10, 20], dtype='int64', name='rand_n')

Column, group, and tag selection¶

To return the statistics for a particular column/group, use the column argument:

>>> pf.stats(column=10)

UserWarning: Metric 'sharpe_ratio' requires frequency to be set

UserWarning: Metric 'calmar_ratio' requires frequency to be set

UserWarning: Metric 'omega_ratio' requires frequency to be set

UserWarning: Metric 'sortino_ratio' requires frequency to be set

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244

Start Value 100.0

End Value 106.721585

Total Return [%] 6.721585

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 22.190944

Max Drawdown Duration 101.0

Total Trades 10

Total Closed Trades 10

Total Open Trades 0

Open Trade PnL 0.0

Win Rate [%] 60.0

Best Trade [%] 15.31962

Worst Trade [%] -9.904223

Avg Winning Trade [%] 4.671959

Avg Losing Trade [%] -4.851205

Avg Winning Trade Duration 11.333333

Avg Losing Trade Duration 14.25

Profit Factor 1.347457

Expectancy 0.672158

Name: 10, dtype: object

If vectorbt couldn't parse the frequency of close:

1) it won't return any duration in time units, 2) it won't return any metric that requires annualization, and 3) it will throw a bunch of warnings (you can silence those by passing silence_warnings=True)

We can provide the frequency as part of the settings dict:

>>> pf.stats(column=10, settings=dict(freq='d'))

UserWarning: Changing the frequency will create a copy of this object.

Consider setting the frequency upon object creation to re-use existing cache.

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Start Value 100.0

End Value 106.721585

Total Return [%] 6.721585

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 22.190944

Max Drawdown Duration 101 days 00:00:00

Total Trades 10

Total Closed Trades 10

Total Open Trades 0

Open Trade PnL 0.0

Win Rate [%] 60.0

Best Trade [%] 15.31962

Worst Trade [%] -9.904223

Avg Winning Trade [%] 4.671959

Avg Losing Trade [%] -4.851205

Avg Winning Trade Duration 11 days 08:00:00

Avg Losing Trade Duration 14 days 06:00:00

Profit Factor 1.347457

Expectancy 0.672158

Sharpe Ratio 0.445231

Calmar Ratio 0.460573

Omega Ratio 1.099192

Sortino Ratio 0.706986

Name: 10, dtype: object

But in this case, our portfolio will be copied to set the new frequency and we wouldn't be able to re-use its cached attributes. Let's define the frequency upon the simulation instead:

>>> pf = vbt.Portfolio.from_random_signals(close, n=[10, 20], seed=42, freq='d')

We can change the grouping of the portfolio on the fly. Let's form a single group:

>>> pf.stats(group_by=True)

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Start Value 200.0

End Value 277.49299

Total Return [%] 38.746495

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 14.219327

Max Drawdown Duration 86 days 00:00:00

Total Trades 30

Total Closed Trades 30

Total Open Trades 0

Open Trade PnL 0.0

Win Rate [%] 66.666667

Best Trade [%] 18.332559

Worst Trade [%] -9.904223

Avg Winning Trade [%] 5.754788

Avg Losing Trade [%] -4.718907

Avg Winning Trade Duration 7 days 19:12:00

Avg Losing Trade Duration 8 days 07:12:00

Profit Factor 2.427948

Expectancy 2.5831

Sharpe Ratio 1.57907

Calmar Ratio 4.445448

Omega Ratio 1.334032

Sortino Ratio 2.59669

Name: group, dtype: object

We can see how the initial cash has changed from $100 to $200, indicating that both columns now contribute to the performance.

Aggregation¶

If the portfolio consists of multiple columns/groups and no column/group has been selected, each metric is aggregated across all columns/groups based on agg_func, which is np.mean by default.

>>> pf.stats()

UserWarning: Object has multiple columns. Aggregating using <function mean at 0x7fc77152bb70>.

Pass column to select a single column/group.

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Start Value 100.0

End Value 138.746495

Total Return [%] 38.746495

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 20.35869

Max Drawdown Duration 93 days 00:00:00

Total Trades 15.0

Total Closed Trades 15.0

Total Open Trades 0.0

Open Trade PnL 0.0

Win Rate [%] 65.0

Best Trade [%] 16.82609

Worst Trade [%] -9.701273

Avg Winning Trade [%] 5.445408

Avg Losing Trade [%] -4.740956

Avg Winning Trade Duration 8 days 19:25:42.857142857

Avg Losing Trade Duration 9 days 07:00:00

Profit Factor 2.186957

Expectancy 2.105364

Sharpe Ratio 1.165695

Calmar Ratio 3.541079

Omega Ratio 1.331624

Sortino Ratio 2.084565

Name: agg_func_mean, dtype: object

Here, the Sharpe ratio of 0.445231 (column=10) and 1.88616 (column=20) lead to the avarage of 1.16569.

We can also return a DataFrame with statistics per column/group by passing agg_func=None:

>>> pf.stats(agg_func=None)

Start End Period ... Sortino Ratio

rand_n ...

10 2020-01-01 00:00:00+00:00 2020-09-01 00:00:00+00:00 244 days ... 0.706986

20 2020-01-01 00:00:00+00:00 2020-09-01 00:00:00+00:00 244 days ... 3.462144

[2 rows x 25 columns]

Metric selection¶

To select metrics, use the metrics argument (see Portfolio.metrics for supported metrics):

>>> pf.stats(metrics=['sharpe_ratio', 'sortino_ratio'], column=10)

Sharpe Ratio 0.445231

Sortino Ratio 0.706986

Name: 10, dtype: float64

We can also select specific tags (see any metric from Portfolio.metrics that has the tag key):

>>> pf.stats(column=10, tags=['trades'])

Total Trades 10

Total Open Trades 0

Open Trade PnL 0

Long Trades [%] 100

Win Rate [%] 60

Best Trade [%] 15.3196

Worst Trade [%] -9.90422

Avg Winning Trade [%] 4.67196

Avg Winning Trade Duration 11 days 08:00:00

Avg Losing Trade [%] -4.8512

Avg Losing Trade Duration 14 days 06:00:00

Profit Factor 1.34746

Expectancy 0.672158

Name: 10, dtype: object

Or provide a boolean expression:

>>> pf.stats(column=10, tags='trades and open and not closed')

Total Open Trades 0.0

Open Trade PnL 0.0

Name: 10, dtype: float64

The reason why we included "not closed" along with "open" is because some metrics such as the win rate have both tags attached since they are based upon both open and closed trades/positions (to see this, pass settings=dict(incl_open=True) and tags='trades and open').

Passing parameters¶

We can use settings to pass parameters used across multiple metrics. For example, let's pass required and risk-free return to all return metrics:

>>> pf.stats(column=10, settings=dict(required_return=0.1, risk_free=0.01))

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Start Value 100.0

End Value 106.721585

Total Return [%] 6.721585

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 22.190944

Max Drawdown Duration 101 days 00:00:00

Total Trades 10

Total Closed Trades 10

Total Open Trades 0

Open Trade PnL 0.0

Win Rate [%] 60.0

Best Trade [%] 15.31962

Worst Trade [%] -9.904223

Avg Winning Trade [%] 4.671959

Avg Losing Trade [%] -4.851205

Avg Winning Trade Duration 11 days 08:00:00

Avg Losing Trade Duration 14 days 06:00:00

Profit Factor 1.347457

Expectancy 0.672158

Sharpe Ratio -9.504742 << here

Calmar Ratio 0.460573 << here

Omega Ratio 0.233279 << here

Sortino Ratio -18.763407 << here

Name: 10, dtype: object

Passing any argument inside of settings either overrides an existing default, or acts as an optional argument that is passed to the calculation function upon resolution (see below). Both required_return and risk_free can be found in the signature of the 4 ratio methods, so vectorbt knows exactly it has to pass them.

Let's imagine that the signature of ReturnsAccessor.sharpe_ratio() doesn't list those arguments: vectorbt would simply call this method without passing those two arguments. In such case, we have two options:

1) Set parameters globally using settings and set pass_{arg}=True individually using metric_settings:

>>> pf.stats(

... column=10,

... settings=dict(required_return=0.1, risk_free=0.01),

... metric_settings=dict(

... sharpe_ratio=dict(pass_risk_free=True),

... omega_ratio=dict(pass_required_return=True, pass_risk_free=True),

... sortino_ratio=dict(pass_required_return=True)

... )

... )

2) Set parameters individually using metric_settings:

>>> pf.stats(

... column=10,

... metric_settings=dict(

... sharpe_ratio=dict(risk_free=0.01),

... omega_ratio=dict(required_return=0.1, risk_free=0.01),

... sortino_ratio=dict(required_return=0.1)

... )

... )

Custom metrics¶

To calculate a custom metric, we need to provide at least two things: short name and a settings dict with the title and calculation function (see arguments in StatsBuilderMixin):

>>> max_winning_streak = (

... 'max_winning_streak',

... dict(

... title='Max Winning Streak',

... calc_func=lambda trades: trades.winning_streak.max(),

... resolve_trades=True

... )

... )

>>> pf.stats(metrics=max_winning_streak, column=10)

Max Winning Streak 3.0

Name: 10, dtype: float64

You might wonder how vectorbt knows which arguments to pass to calc_func? In the example above, the calculation function expects two arguments: trades and group_by. To automatically pass any of the them, vectorbt searches for each in the current settings. As trades cannot be found, it either throws an error or tries to resolve this argument if resolve_{arg}=True was passed. Argument resolution is the process of searching for property/method with the same name (also with prefix get_) in the attributes of the current portfolio, automatically passing the current settings such as group_by if they are present in the method's signature (a similar resolution procedure), and calling the method/property. The result of the resolution process is then passed as arg (or trades in our example).

Here's an example without resolution of arguments:

>>> max_winning_streak = (

... 'max_winning_streak',

... dict(

... title='Max Winning Streak',

... calc_func=lambda self, group_by:

... self.get_trades(group_by=group_by).winning_streak.max()

... )

... )

>>> pf.stats(metrics=max_winning_streak, column=10)

Max Winning Streak 3.0

Name: 10, dtype: float64

And here's an example without resolution of the calculation function:

>>> max_winning_streak = (

... 'max_winning_streak',

... dict(

... title='Max Winning Streak',

... calc_func=lambda self, settings:

... self.get_trades(group_by=settings['group_by']).winning_streak.max(),

... resolve_calc_func=False

... )

... )

>>> pf.stats(metrics=max_winning_streak, column=10)

Max Winning Streak 3.0

Name: 10, dtype: float64

Since max_winning_streak method can be expressed as a path from this portfolio, we can simply write:

>>> max_winning_streak = (

... 'max_winning_streak',

... dict(

... title='Max Winning Streak',

... calc_func='trades.winning_streak.max'

... )

... )

In this case, we don't have to pass resolve_trades=True any more as vectorbt does it automatically. Another advantage is that vectorbt can access the signature of the last method in the path (MappedArray.max() in our case) and resolve its arguments.

To switch between entry trades, exit trades, and positions, use the trades_type setting. Additionally, you can pass incl_open=True to also include open trades.

>>> pf.stats(column=10, settings=dict(trades_type='positions', incl_open=True))

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Start Value 100.0

End Value 106.721585

Total Return [%] 6.721585

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 22.190944

Max Drawdown Duration 100 days 00:00:00

Total Trades 10

Total Closed Trades 10

Total Open Trades 0

Open Trade PnL 0.0

Win Rate [%] 60.0

Best Trade [%] 15.31962

Worst Trade [%] -9.904223

Avg Winning Trade [%] 4.671959

Avg Losing Trade [%] -4.851205

Avg Winning Trade Duration 11 days 08:00:00

Avg Losing Trade Duration 14 days 06:00:00

Profit Factor 1.347457

Expectancy 0.672158

Sharpe Ratio 0.445231

Calmar Ratio 0.460573

Omega Ratio 1.099192

Sortino Ratio 0.706986

Name: 10, dtype: object

Any default metric setting or even global setting can be overridden by the user using metric-specific keyword arguments. Here, we override the global aggregation function for max_dd_duration:

>>> pf.stats(agg_func=lambda sr: sr.mean(),

... metric_settings=dict(

... max_dd_duration=dict(agg_func=lambda sr: sr.max())

... )

... )

UserWarning: Object has multiple columns. Aggregating using <function <lambda> at 0x7fbf6e77b268>.

Pass column to select a single column/group.

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Start Value 100.0

End Value 138.746495

Total Return [%] 38.746495

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 20.35869

Max Drawdown Duration 101 days 00:00:00 << here

Total Trades 15.0

Total Closed Trades 15.0

Total Open Trades 0.0

Open Trade PnL 0.0

Win Rate [%] 65.0

Best Trade [%] 16.82609

Worst Trade [%] -9.701273

Avg Winning Trade [%] 5.445408

Avg Losing Trade [%] -4.740956

Avg Winning Trade Duration 8 days 19:25:42.857142857

Avg Losing Trade Duration 9 days 07:00:00

Profit Factor 2.186957

Expectancy 2.105364

Sharpe Ratio 1.165695

Calmar Ratio 3.541079

Omega Ratio 1.331624

Sortino Ratio 2.084565

Name: agg_func_<lambda>, dtype: object

Let's create a simple metric that returns a passed value to demonstrate how vectorbt overrides settings, from least to most important:

>>> # vbt.settings.portfolio.stats

>>> vbt.settings.portfolio.stats['settings']['my_arg'] = 100

>>> my_arg_metric = ('my_arg_metric', dict(title='My Arg', calc_func=lambda my_arg: my_arg))

>>> pf.stats(my_arg_metric, column=10)

My Arg 100

Name: 10, dtype: int64

>>> # settings >>> vbt.settings.portfolio.stats

>>> pf.stats(my_arg_metric, column=10, settings=dict(my_arg=200))

My Arg 200

Name: 10, dtype: int64

>>> # metric settings >>> settings

>>> my_arg_metric = ('my_arg_metric', dict(title='My Arg', my_arg=300, calc_func=lambda my_arg: my_arg))

>>> pf.stats(my_arg_metric, column=10, settings=dict(my_arg=200))

My Arg 300

Name: 10, dtype: int64

>>> # metric_settings >>> metric settings

>>> pf.stats(my_arg_metric, column=10, settings=dict(my_arg=200),

... metric_settings=dict(my_arg_metric=dict(my_arg=400)))

My Arg 400

Name: 10, dtype: int64

Here's an example of a parametrized metric. Let's get the number of trades with PnL over some amount:

>>> trade_min_pnl_cnt = (

... 'trade_min_pnl_cnt',

... dict(

... title=vbt.Sub('Trades with PnL over $$${min_pnl}'),

... calc_func=lambda trades, min_pnl: trades.apply_mask(

... trades.pnl.values >= min_pnl).count(),

... resolve_trades=True

... )

... )

>>> pf.stats(

... metrics=trade_min_pnl_cnt, column=10,

... metric_settings=dict(trade_min_pnl_cnt=dict(min_pnl=0)))

Trades with PnL over $0 6

Name: stats, dtype: int64

>>> pf.stats(

... metrics=trade_min_pnl_cnt, column=10,

... metric_settings=dict(trade_min_pnl_cnt=dict(min_pnl=10)))

Trades with PnL over $10 1

Name: stats, dtype: int64

If the same metric name was encountered more than once, vectorbt automatically appends an underscore and its position, so we can pass keyword arguments to each metric separately:

>>> pf.stats(

... metrics=[

... trade_min_pnl_cnt,

... trade_min_pnl_cnt,

... trade_min_pnl_cnt

... ],

... column=10,

... metric_settings=dict(

... trade_min_pnl_cnt_0=dict(min_pnl=0),

... trade_min_pnl_cnt_1=dict(min_pnl=10),

... trade_min_pnl_cnt_2=dict(min_pnl=20))

... )

Trades with PnL over $0 6

Trades with PnL over $10 1

Trades with PnL over $20 0

Name: stats, dtype: int64

To add a custom metric to the list of all metrics, we have three options.

The first option is to change the Portfolio.metrics dict in-place (this will append to the end):

>>> pf.metrics['max_winning_streak'] = max_winning_streak[1]

>>> pf.stats(column=10)

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Start Value 100.0

End Value 106.721585

Total Return [%] 6.721585

Benchmark Return [%] 66.252621

Max Gross Exposure [%] 100.0

Total Fees Paid 0.0

Max Drawdown [%] 22.190944

Max Drawdown Duration 101 days 00:00:00

Total Trades 10

Total Closed Trades 10

Total Open Trades 0

Open Trade PnL 0.0

Win Rate [%] 60.0

Best Trade [%] 15.31962

Worst Trade [%] -9.904223

Avg Winning Trade [%] 4.671959

Avg Losing Trade [%] -4.851205

Avg Winning Trade Duration 11 days 08:00:00

Avg Losing Trade Duration 14 days 06:00:00

Profit Factor 1.347457

Expectancy 0.672158

Sharpe Ratio 0.445231

Calmar Ratio 0.460573

Omega Ratio 1.099192

Sortino Ratio 0.706986

Max Winning Streak 3.0 << here

Name: 10, dtype: object

Since Portfolio.metrics is of type Config, we can reset it at any time to get default metrics:

>>> pf.metrics.reset()

The second option is to copy Portfolio.metrics, append our metric, and pass as metrics argument:

>>> my_metrics = list(pf.metrics.items()) + [max_winning_streak]

>>> pf.stats(metrics=my_metrics, column=10)

The third option is to set metrics globally under portfolio.stats in settings.

>>> vbt.settings.portfolio['stats']['metrics'] = my_metrics

>>> pf.stats(column=10)

Returns stats¶

We can compute the stats solely based on the portfolio's returns using Portfolio.returns_stats(), which calls StatsBuilderMixin.stats().

>>> pf.returns_stats(column=10)

Start 2020-01-01 00:00:00+00:00

End 2020-09-01 00:00:00+00:00

Period 244 days 00:00:00

Total Return [%] 6.721585

Benchmark Return [%] 66.252621

Annualized Return [%] 10.22056

Annualized Volatility [%] 36.683518

Max Drawdown [%] 22.190944

Max Drawdown Duration 100 days 00:00:00

Sharpe Ratio 0.445231

Calmar Ratio 0.460573

Omega Ratio 1.099192

Sortino Ratio 0.706986

Skew 1.328259

Kurtosis 10.80246

Tail Ratio 1.057913

Common Sense Ratio 1.166037

Value at Risk -0.031011

Alpha -0.075109

Beta 0.220351

Name: 10, dtype: object

Most metrics defined in ReturnsAccessor are also available as attributes of Portfolio:

>>> pf.sharpe_ratio()

randnx_n

10 0.445231

20 1.886158

Name: sharpe_ratio, dtype: float64

Moreover, we can access quantstats functions using QSAdapter:

>>> pf.qs.sharpe()

randnx_n

10 0.445231

20 1.886158

dtype: float64

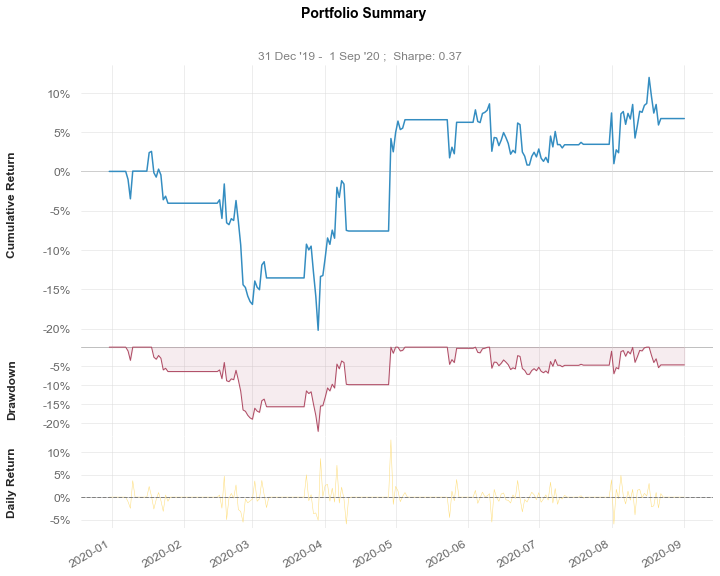

>>> pf[10].qs.plot_snapshot()

Plots¶

Hint

See PlotsBuilderMixin.plots().

The features implemented in this method are very similar to StatsBuilderMixin.stats(). See also the examples under StatsBuilderMixin.stats().

Plot portfolio of a random strategy:

>>> pf.plot(column=10)

You can choose any of the subplots in Portfolio.subplots, in any order, and control their appearance using keyword arguments:

>>> pf.plot(

... subplots=['drawdowns', 'underwater'],

... column=10,

... subplot_settings=dict(

... drawdowns=dict(top_n=3),

... underwater=dict(

... trace_kwargs=dict(

... line=dict(color='#FF6F00'),

... fillcolor=adjust_opacity('#FF6F00', 0.3)

... )

... )

... )

... )

To create a new subplot, a preferred way is to pass a plotting function:

>>> def plot_order_size(pf, size, column=None, add_trace_kwargs=None, fig=None):

... size = pf.select_one_from_obj(size, pf.wrapper.regroup(False), column=column)

... size.rename('Order Size').vbt.barplot(

... add_trace_kwargs=add_trace_kwargs, fig=fig)

>>> order_size = pf.orders.size.to_pd(fill_value=0.)

>>> pf.plot(subplots=[

... 'orders',

... ('order_size', dict(

... title='Order Size',

... yaxis_kwargs=dict(title='Order size'),

... check_is_not_grouped=True,

... plot_func=plot_order_size

... ))

... ],

... column=10,

... subplot_settings=dict(

... order_size=dict(

... size=order_size

... )

... )

... )

Alternatively, you can create a placeholder and overwrite it manually later:

>>> fig = pf.plot(subplots=[

... 'orders',

... ('order_size', dict(

... title='Order Size',

... yaxis_kwargs=dict(title='Order size'),

... check_is_not_grouped=True

... )) # placeholder

... ], column=10)

>>> order_size[10].rename('Order Size').vbt.barplot(

... add_trace_kwargs=dict(row=2, col=1),

... fig=fig

... )

If a plotting function can in any way be accessed from the current portfolio, you can pass the path to this function (see deep_getattr() for the path format). You can additionally use templates to make some parameters to depend upon passed keyword arguments:

>>> subplots = [

... ('cumulative_returns', dict(

... title='Cumulative Returns',

... yaxis_kwargs=dict(title='Cumulative returns'),

... plot_func='returns.vbt.returns.cumulative.vbt.plot',

... pass_add_trace_kwargs=True

... )),

... ('rolling_drawdown', dict(

... title='Rolling Drawdown',

... yaxis_kwargs=dict(title='Rolling drawdown'),

... plot_func=[

... 'returns.vbt.returns', # returns accessor

... (

... 'rolling_max_drawdown', # function name

... (vbt.Rep('window'),)), # positional arguments

... 'vbt.plot' # plotting function

... ],

... pass_add_trace_kwargs=True,

... trace_names=[vbt.Sub('rolling_drawdown(${window})')], # add window to the trace name

... ))

... ]

>>> pf.plot(

... subplots,

... column=10,

... subplot_settings=dict(

... rolling_drawdown=dict(

... template_mapping=dict(

... window=10

... )

... )

... )

... )

You can also replace templates across all subplots by using the global template mapping:

>>> pf.plot(subplots, column=10, template_mapping=dict(window=10))

returns_acc_config Config¶

Config of returns accessor methods to be added to Portfolio.

Config({

"daily_returns": {

"source_name": "daily"

},

"annual_returns": {

"source_name": "annual"

},

"cumulative_returns": {

"source_name": "cumulative"

},

"annualized_return": {

"source_name": "annualized"

},

"annualized_volatility": {},

"calmar_ratio": {},

"omega_ratio": {},

"sharpe_ratio": {},

"deflated_sharpe_ratio": {},

"downside_risk": {},

"sortino_ratio": {},

"information_ratio": {},

"beta": {},

"alpha": {},

"tail_ratio": {},

"value_at_risk": {},

"cond_value_at_risk": {},

"capture": {},

"up_capture": {},

"down_capture": {},

"drawdown": {},

"max_drawdown": {}

})

MetaPortfolio class¶

MetaPortfolio(

*args,

**kwargs

)

Meta class that exposes a read-only class property StatsBuilderMixin.metrics.

Superclasses

- MetaPlotsBuilderMixin

- MetaStatsBuilderMixin

builtins.type

Inherited members

Portfolio class¶

Portfolio(

wrapper,

close,

order_records,

log_records,

init_cash,

cash_sharing,

call_seq=None,

fillna_close=None,

trades_type=None

)

Class for modeling portfolio and measuring its performance.

Args

wrapper:ArrayWrapper-

Array wrapper.

See ArrayWrapper.

close:array_like- Last asset price at each time step.

order_records:array_like- A structured NumPy array of order records.

log_records:array_like- A structured NumPy array of log records.

init_cash:InitCashMode,floatorarray_likeoffloat- Initial capital.

cash_sharing:bool- Whether to share cash within the same group.

call_seq:array_likeofint- Sequence of calls per row and group. Defaults to None.

fillna_close:bool-

Whether to forward and backward fill NaN values in

close.Applied after the simulation to avoid NaNs in asset value.

trades_type:strorint-

Default Trades to use across Portfolio.

See TradesType.

For defaults, see portfolio in settings.

Note

Use class methods with from_ prefix to build a portfolio. The __init__ method is reserved for indexing purposes.

Note

This class is meant to be immutable. To change any attribute, use Configured.replace().

Superclasses

- AttrResolver

- Configured

- Documented

- IndexingBase

- PandasIndexer

- Pickleable

- PlotsBuilderMixin

- StatsBuilderMixin

- Wrapping

Inherited members

- AttrResolver.deep_getattr()

- AttrResolver.resolve_attr()

- Configured.copy()

- Configured.dumps()

- Configured.loads()

- Configured.replace()

- Configured.to_doc()

- Configured.update_config()

- PandasIndexer.xs()

- Pickleable.load()

- Pickleable.save()

- PlotsBuilderMixin.build_subplots_doc()

- PlotsBuilderMixin.override_subplots_doc()

- PlotsBuilderMixin.plots()

- StatsBuilderMixin.build_metrics_doc()

- StatsBuilderMixin.override_metrics_doc()

- StatsBuilderMixin.stats()

- Wrapping.config

- Wrapping.iloc

- Wrapping.indexing_kwargs

- Wrapping.loc

- Wrapping.resolve_self()

- Wrapping.select_one()

- Wrapping.select_one_from_obj()

- Wrapping.self_aliases

- Wrapping.wrapper

- Wrapping.writeable_attrs

alpha method¶

Portfolio.alpha(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

annual_returns method¶

Portfolio.annual_returns(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

annualized_return method¶

Portfolio.annualized_return(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.annualized().

annualized_volatility method¶

Portfolio.annualized_volatility(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.annualized_volatility().

asset_flow method¶

Portfolio.asset_flow(

direction='both',

wrap_kwargs=None

)

Get asset flow series per column.

Returns the total transacted amount of assets at each time step.

asset_returns method¶

Portfolio.asset_returns(

group_by=None,

wrap_kwargs=None

)

Get asset return series per column/group.

This type of returns is based solely on cash flows and asset value rather than portfolio value. It ignores passive cash and thus it will return the same numbers irrespective of the amount of cash currently available, even np.inf. The scale of returns is comparable to that of going all in and keeping available cash at zero.

asset_value method¶

Portfolio.asset_value(

direction='both',

group_by=None,

wrap_kwargs=None

)

Get asset value series per column/group.

assets method¶

Portfolio.assets(

direction='both',

wrap_kwargs=None

)

Get asset series per column.

Returns the current position at each time step.

benchmark_rets method¶

Portfolio.benchmark_returns(

group_by=None,

wrap_kwargs=None

)

Get return series per column/group based on benchmark value.

benchmark_returns method¶

Portfolio.benchmark_returns(

group_by=None,

wrap_kwargs=None

)

Get return series per column/group based on benchmark value.

benchmark_value method¶

Portfolio.benchmark_value(

group_by=None,

wrap_kwargs=None

)

Get market benchmark value series per column/group.

If grouped, evenly distributes the initial cash among assets in the group.

Note

Does not take into account fees and slippage. For this, create a separate portfolio.

beta method¶

Portfolio.beta(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

call_seq property¶

Sequence of calls per row and group.

calmar_ratio method¶

Portfolio.calmar_ratio(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.calmar_ratio().

capture method¶

Portfolio.capture(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.capture().

cash method¶

Portfolio.cash(

group_by=None,

in_sim_order=False,

free=False,

wrap_kwargs=None

)

Get cash balance series per column/group.

See the explanation on in_sim_order in Portfolio.value(). For free, see Portfolio.cash_flow().

cash_flow method¶

Portfolio.cash_flow(

group_by=None,

free=False,

wrap_kwargs=None

)

Get cash flow series per column/group.

Use free to return the flow of the free cash, which never goes above the initial level, because an operation always costs money.

cash_sharing property¶

Whether to share cash within the same group.

close property¶

Price per unit series.

cond_value_at_risk method¶

Portfolio.cond_value_at_risk(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.cond_value_at_risk().

cumulative_returns method¶

Portfolio.cumulative_returns(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.cumulative().

daily_returns method¶

Portfolio.daily_returns(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

deflated_sharpe_ratio method¶

Portfolio.deflated_sharpe_ratio(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.deflated_sharpe_ratio().

down_capture method¶

Portfolio.down_capture(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.down_capture().

downside_risk method¶

Portfolio.downside_risk(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.downside_risk().

drawdown method¶

Portfolio.drawdown(

*,

group_by=None,

benchmark_rets=None,

freq=None,

year_freq=None,

use_asset_returns=False,

**kwargs

)

See ReturnsAccessor.drawdown().

drawdowns method¶

Portfolio.get_drawdowns() with default arguments.

entry_trades method¶

Portfolio.get_entry_trades() with default arguments.

exit_trades method¶

Portfolio.get_exit_trades() with default arguments.

fillna_close property¶

Whether to forward-backward fill NaN values in Portfolio.close.

final_value method¶

Portfolio.final_value(

group_by=None,

wrap_kwargs=None

)

Get total profit per column/group.

from_holding class method¶

Portfolio.from_holding(

close,

**kwargs

)

Simulate portfolio from holding.

Based on Portfolio.from_signals().

>>> close = pd.Series([1, 2, 3, 4, 5])

>>> pf = vbt.Portfolio.from_holding(close)

>>> pf.final_value()

500.0

from_order_func class method¶

Portfolio.from_order_func(

close,

order_func_nb,

*order_args,

flexible=None,

init_cash=None,

cash_sharing=None,

call_seq=None,

segment_mask=None,

call_pre_segment=None,

call_post_segment=None,

pre_sim_func_nb=no_pre_func_nb,

pre_sim_args=(),

post_sim_func_nb=no_post_func_nb,

post_sim_args=(),

pre_group_func_nb=no_pre_func_nb,

pre_group_args=(),

post_group_func_nb=no_post_func_nb,

post_group_args=(),

pre_row_func_nb=no_pre_func_nb,

pre_row_args=(),

post_row_func_nb=no_post_func_nb,

post_row_args=(),

pre_segment_func_nb=no_pre_func_nb,

pre_segment_args=(),

post_segment_func_nb=no_post_func_nb,

post_segment_args=(),

post_order_func_nb=no_post_func_nb,

post_order_args=(),

ffill_val_price=None,

update_value=None,

fill_pos_record=None,

row_wise=None,

use_numba=None,

max_orders=None,

max_logs=None,

seed=None,

group_by=None,

broadcast_named_args=None,

broadcast_kwargs=None,

template_mapping=None,

wrapper_kwargs=None,

freq=None,

attach_call_seq=None,

**kwargs

)

Build portfolio from a custom order function.

Hint

See simulate_nb() for illustrations and argument definitions.

For more details on individual simulation functions:

- not

row_wiseand notflexible: See simulate_nb() - not

row_wiseandflexible: See flex_simulate_nb() row_wiseand notflexible: See simulate_row_wise_nb()row_wiseandflexible: See flex_simulate_row_wise_nb()

Args

close:array_like-

Last asset price at each time step. Will broadcast to

target_shape.Used for calculating unrealized PnL and portfolio value.

order_func_nb:callable- Order generation function.

*order_args- Arguments passed to

order_func_nb. flexible:bool-

Whether to simulate using a flexible order function.

This lifts the limit of one order per tick and symbol.

init_cash:InitCashMode,floatorarray_likeoffloat-

Initial capital.

See

init_cashin Portfolio.from_orders(). cash_sharing:bool-

Whether to share cash within the same group.

If

group_byis None,group_bybecomes True to form a single group with cash sharing. call_seq:CallSeqTypeorarray_like-

Default sequence of calls per row and group.

- Use CallSeqType to select a sequence type.

- Set to array to specify custom sequence. Will not broadcast.

Note

CallSeqType.Auto should be implemented manually. Use sort_call_seq_nb() or sort_call_seq_out_nb() in

pre_segment_func_nb. segment_mask:intorarray_likeofbool-

Mask of whether a particular segment should be executed.

Supplying an integer will activate every n-th row. Supplying a boolean or an array of boolean will broadcast to the number of rows and groups.

Does not broadcast together with

closeandbroadcast_named_args, only against the final shape. call_pre_segment:bool- Whether to call

pre_segment_func_nbregardless ofsegment_mask. call_post_segment:bool- Whether to call

post_segment_func_nbregardless ofsegment_mask. pre_sim_func_nb:callable- Function called before simulation. Defaults to no_pre_func_nb().

pre_sim_args:tuple- Packed arguments passed to

pre_sim_func_nb. Defaults to(). post_sim_func_nb:callable- Function called after simulation. Defaults to no_post_func_nb().

post_sim_args:tuple- Packed arguments passed to

post_sim_func_nb. Defaults to(). pre_group_func_nb:callable-

Function called before each group. Defaults to no_pre_func_nb().

Called only if

row_wiseis False. pre_group_args:tuple- Packed arguments passed to

pre_group_func_nb. Defaults to(). post_group_func_nb:callable-

Function called after each group. Defaults to no_post_func_nb().

Called only if

row_wiseis False. post_group_args:tuple- Packed arguments passed to

post_group_func_nb. Defaults to(). pre_row_func_nb:callable-

Function called before each row. Defaults to no_pre_func_nb().

Called only if

row_wiseis True. pre_row_args:tuple- Packed arguments passed to

pre_row_func_nb. Defaults to(). post_row_func_nb:callable-

Function called after each row. Defaults to no_post_func_nb().

Called only if

row_wiseis True. post_row_args:tuple- Packed arguments passed to

post_row_func_nb. Defaults to(). pre_segment_func_nb:callable- Function called before each segment. Defaults to no_pre_func_nb().

pre_segment_args:tuple- Packed arguments passed to

pre_segment_func_nb. Defaults to(). post_segment_func_nb:callable- Function called after each segment. Defaults to no_post_func_nb().

post_segment_args:tuple- Packed arguments passed to

post_segment_func_nb. Defaults to(). post_order_func_nb:callable- Callback that is called after the order has been processed.

post_order_args:tuple- Packed arguments passed to

post_order_func_nb. Defaults to(). ffill_val_price:bool-

Whether to track valuation price only if it's known.

Otherwise, unknown

closewill lead to NaN in valuation price at the next timestamp. update_value:bool- Whether to update group value after each filled order.

fill_pos_record:bool-

Whether to fill position record.

Disable this to make simulation a bit faster for simple use cases.

row_wise:bool- Whether to iterate over rows rather than columns/groups.

use_numba:bool-

Whether to run the main simulation function using Numba.

Note

Disabling it does not disable Numba for other functions. If necessary, you should ensure that every other function does not uses Numba as well. You can do this by using the

py_funcattribute of that function. Or, you could disable Numba globally by doingos.environ['NUMBA_DISABLE_JIT'] = '1'. max_orders:int-

Size of the order records array. Defaults to the number of elements in the broadcasted shape.

Set to a lower number if you run out of memory.

max_logs:int-

Size of the log records array. Defaults to the number of elements in the broadcasted shape.

Set to a lower number if you run out of memory.

seed:int- See Portfolio.from_orders().

group_by:any- See Portfolio.from_orders().

broadcast_named_args:dict- See Portfolio.from_signals().

broadcast_kwargs:dict- See Portfolio.from_orders().

template_mapping:mapping- See Portfolio.from_signals().

wrapper_kwargs:dict- See Portfolio.from_orders().

freq:any- See Portfolio.from_orders().

attach_call_seq:bool- See Portfolio.from_orders().

**kwargs- Keyword arguments passed to the

__init__method.

For defaults, see portfolio in settings.

Note

All passed functions should be Numba-compiled if Numba is enabled.

Also see notes on Portfolio.from_orders().

Note

In contrast to other methods, the valuation price is previous close instead of the order price since the price of an order is unknown before the call (which is more realistic by the way). You can still override the valuation price in pre_segment_func_nb.

Usage

- Buy 10 units each tick using closing price:

>>> @njit

... def order_func_nb(c, size):

... return nb.order_nb(size=size)

>>> close = pd.Series([1, 2, 3, 4, 5])

>>> pf = vbt.Portfolio.from_order_func(close, order_func_nb, 10)

>>> pf.assets()

0 10.0

1 20.0

2 30.0

3 40.0

4 40.0

dtype: float64

>>> pf.cash()

0 90.0

1 70.0

2 40.0

3 0.0

4 0.0

dtype: float64

- Reverse each position by first closing it. Keep state of last position to determine which position to open next (just as an example, there are easier ways to do this):

>>> @njit

... def pre_group_func_nb(c):

... last_pos_state = np.array([-1])

... return (last_pos_state,)

>>> @njit

... def order_func_nb(c, last_pos_state):

... if c.position_now != 0:

... return nb.close_position_nb()

...

... if last_pos_state[0] == 1:

... size = -np.inf # open short

... last_pos_state[0] = -1

... else:

... size = np.inf # open long

... last_pos_state[0] = 1

... return nb.order_nb(size=size)

>>> pf = vbt.Portfolio.from_order_func(

... close,

... order_func_nb,

... pre_group_func_nb=pre_group_func_nb

... )

>>> pf.assets()

0 100.000000

1 0.000000

2 -66.666667

3 0.000000

4 26.666667

dtype: float64

>>> pf.cash()

0 0.000000

1 200.000000

2 400.000000

3 133.333333

4 0.000000

dtype: float64

- Equal-weighted portfolio as in the example under simulate_nb():

>>> @njit

... def pre_group_func_nb(c):

... order_value_out = np.empty(c.group_len, dtype=np.float64)

... return (order_value_out,)

>>> @njit

... def pre_segment_func_nb(c, order_value_out, size, price, size_type, direction):

... for col in range(c.from_col, c.to_col):

... c.last_val_price[col] = nb.get_col_elem_nb(c, col, price)

... nb.sort_call_seq_nb(c, size, size_type, direction, order_value_out)

... return ()

>>> @njit

... def order_func_nb(c, size, price, size_type, direction, fees, fixed_fees, slippage):

... return nb.order_nb(

... size=nb.get_elem_nb(c, size),

... price=nb.get_elem_nb(c, price),

... size_type=nb.get_elem_nb(c, size_type),

... direction=nb.get_elem_nb(c, direction),

... fees=nb.get_elem_nb(c, fees),

... fixed_fees=nb.get_elem_nb(c, fixed_fees),

... slippage=nb.get_elem_nb(c, slippage)

... )

>>> np.random.seed(42)

>>> close = np.random.uniform(1, 10, size=(5, 3))

>>> size_template = vbt.RepEval('np.asarray(1 / group_lens[0])')

>>> pf = vbt.Portfolio.from_order_func(

... close,

... order_func_nb,

... size_template, # order_args as *args

... vbt.Rep('price'),

... vbt.Rep('size_type'),

... vbt.Rep('direction'),

... vbt.Rep('fees'),

... vbt.Rep('fixed_fees'),

... vbt.Rep('slippage'),

... segment_mask=2, # rebalance every second tick

... pre_group_func_nb=pre_group_func_nb,

... pre_segment_func_nb=pre_segment_func_nb,

... pre_segment_args=(

... size_template,

... vbt.Rep('price'),

... vbt.Rep('size_type'),

... vbt.Rep('direction')

... ),

... broadcast_named_args=dict( # broadcast against each other

... price=close,

... size_type=SizeType.TargetPercent,

... direction=Direction.LongOnly,

... fees=0.001,

... fixed_fees=1.,

... slippage=0.001

... ),

... template_mapping=dict(np=np), # required by size_template

... cash_sharing=True, group_by=True, # one group with cash sharing

... )

>>> pf.asset_value(group_by=False).vbt.plot()

Templates are a very powerful tool to prepare any custom arguments after they are broadcast and before they are passed to the simulation function. In the example above, we use broadcast_named_args to broadcast some arguments against each other and templates to pass those objects to callbacks. Additionally, we used an evaluation template to compute the size based on the number of assets in each group.

You may ask: why should we bother using broadcasting and templates if we could just pass size=1/3? Because of flexibility those features provide: we can now pass whatever parameter combinations we want and it will work flawlessly. For example, to create two groups of equally-allocated positions, we need to change only two parameters:

>>> close = np.random.uniform(1, 10, size=(5, 6)) # 6 columns instead of 3

>>> group_by = ['g1', 'g1', 'g1', 'g2', 'g2', 'g2'] # 2 groups instead of 1

>>> pf['g1'].asset_value(group_by=False).vbt.plot()

>>> pf['g2'].asset_value(group_by=False).vbt.plot()

- Combine multiple exit conditions. Exit early if the price hits some threshold before an actual exit:

>>> @njit

... def pre_sim_func_nb(c):

... # We need to define stop price per column once

... stop_price = np.full(c.target_shape[1], np.nan, dtype=np.float64)

... return (stop_price,)

>>> @njit

... def order_func_nb(c, stop_price, entries, exits, size):

... # Select info related to this order

... entry_now = nb.get_elem_nb(c, entries)

... exit_now = nb.get_elem_nb(c, exits)

... size_now = nb.get_elem_nb(c, size)

... price_now = nb.get_elem_nb(c, c.close)

... stop_price_now = stop_price[c.col]

...

... # Our logic

... if entry_now:

... if c.position_now == 0:

... return nb.order_nb(

... size=size_now,

... price=price_now,

... direction=Direction.LongOnly)

... elif exit_now or price_now >= stop_price_now:

... if c.position_now > 0:

... return nb.order_nb(

... size=-size_now,

... price=price_now,

... direction=Direction.LongOnly)

... return NoOrder

>>> @njit

... def post_order_func_nb(c, stop_price, stop):

... # Same broadcasting as for size

... stop_now = nb.get_elem_nb(c, stop)

...

... if c.order_result.status == OrderStatus.Filled:

... if c.order_result.side == OrderSide.Buy:

... # Position entered: Set stop condition

... stop_price[c.col] = (1 + stop_now) * c.order_result.price

... else:

... # Position exited: Remove stop condition

... stop_price[c.col] = np.nan

>>> def simulate(close, entries, exits, size, threshold):

... return vbt.Portfolio.from_order_func(

... close,

... order_func_nb,

... vbt.Rep('entries'), vbt.Rep('exits'), vbt.Rep('size'), # order_args

... pre_sim_func_nb=pre_sim_func_nb,

... post_order_func_nb=post_order_func_nb,

... post_order_args=(vbt.Rep('threshold'),),

... broadcast_named_args=dict( # broadcast against each other

... entries=entries,

... exits=exits,

... size=size,

... threshold=threshold

... )

... )

>>> close = pd.Series([10, 11, 12, 13, 14])

>>> entries = pd.Series([True, True, False, False, False])

>>> exits = pd.Series([False, False, False, True, True])

>>> simulate(close, entries, exits, np.inf, 0.1).asset_flow()

0 10.0

1 0.0

2 -10.0

3 0.0

4 0.0

dtype: float64

>>> simulate(close, entries, exits, np.inf, 0.2).asset_flow()

0 10.0

1 0.0

2 -10.0

3 0.0

4 0.0

dtype: float64

>>> simulate(close, entries, exits, np.nan).asset_flow()

0 10.0

1 0.0

2 0.0

3 -10.0

4 0.0

dtype: float64

The reason why stop of 10% does not result in an order at the second time step is because it comes at the same time as entry, so it must wait until no entry is present. This can be changed by replacing the statement "elif" with "if", which would execute an exit regardless if an entry is present (similar to using ConflictMode.Opposite in Portfolio.from_signals()).

We can also test the parameter combinations above all at once (thanks to broadcasting):

>>> size = pd.DataFrame(

... [[0.1, 0.2, np.nan]],

... columns=pd.Index(['0.1', '0.2', 'nan'], name='size')

... )

>>> simulate(close, entries, exits, np.inf, size).asset_flow()

size 0.1 0.2 nan

0 10.0 10.0 10.0

1 0.0 0.0 0.0

2 -10.0 -10.0 0.0

3 0.0 0.0 -10.0

4 0.0 0.0 0.0

- Let's illustrate how to generate multiple orders per symbol and bar. For each bar, buy at open and sell at close:

>>> @njit

... def flex_order_func_nb(c, open, size):

... if c.call_idx == 0:

... return c.from_col, nb.order_nb(size=size, price=open[c.i, c.from_col])

... if c.call_idx == 1:

... return c.from_col, nb.close_position_nb(price=c.close[c.i, c.from_col])

... return -1, NoOrder

>>> open = pd.DataFrame({'a': [1, 2, 3], 'b': [4, 5, 6]})

>>> close = pd.DataFrame({'a': [2, 3, 4], 'b': [3, 4, 5]})

>>> size = 1

>>> pf = vbt.Portfolio.from_order_func(

... close,

... flex_order_func_nb,

... to_2d_array(open), size,

... flexible=True, max_orders=close.shape[0] * close.shape[1] * 2)

>>> pf.orders.records_readable

Order Id Timestamp Column Size Price Fees Side

0 0 0 a 1.0 1.0 0.0 Buy

1 1 0 a 1.0 2.0 0.0 Sell

2 2 1 a 1.0 2.0 0.0 Buy

3 3 1 a 1.0 3.0 0.0 Sell

4 4 2 a 1.0 3.0 0.0 Buy

5 5 2 a 1.0 4.0 0.0 Sell

6 6 0 b 1.0 4.0 0.0 Buy

7 7 0 b 1.0 3.0 0.0 Sell

8 8 1 b 1.0 5.0 0.0 Buy

9 9 1 b 1.0 4.0 0.0 Sell

10 10 2 b 1.0 6.0 0.0 Buy

11 11 2 b 1.0 5.0 0.0 Sell

Warning

Each bar is effectively a black box - we don't know how the price moves inside. Since trades must come in an order that replicates that of the real world, the only reliable pieces of information are the opening and the closing price.

from_orders class method¶

Portfolio.from_orders(

close,

size=None,

size_type=None,

direction=None,

price=None,

fees=None,

fixed_fees=None,

slippage=None,

min_size=None,

max_size=None,

size_granularity=None,

reject_prob=None,

lock_cash=None,

allow_partial=None,

raise_reject=None,

log=None,

val_price=None,

init_cash=None,

cash_sharing=None,

call_seq=None,

ffill_val_price=None,

update_value=None,

max_orders=None,

max_logs=None,

seed=None,

group_by=None,

broadcast_kwargs=None,

wrapper_kwargs=None,

freq=None,

attach_call_seq=None,

**kwargs

)

Simulate portfolio from orders - size, price, fees, and other information.

Args

close:array_like-

Last asset price at each time step. Will broadcast.

Used for calculating unrealized PnL and portfolio value.

size:floatorarray_like- Size to order. See Order.size. Will broadcast.

size_type:SizeTypeorarray_like-

See SizeType. See Order.size_type. Will broadcast.

Note

SizeType.Percentdoes not support position reversal. Switch to a single direction.Warning

Be cautious using

SizeType.Percentwithcall_seqset to 'auto'. To execute sell orders before buy orders, the value of each order in the group needs to be approximated in advance. But sinceSizeType.Percentdepends upon the cash balance, which cannot be calculated in advance since it may change after each order, this can yield a non-optimal call sequence. direction:Directionorarray_like- See Direction. See Order.direction. Will broadcast.

price:array_likeoffloat-

Order price. See Order.price. Defaults to

np.inf. Will broadcast.Note

Make sure to use the same timestamp for all order prices in the group with cash sharing and

call_seqset toCallSeqType.Auto. fees:floatorarray_like- Fees in percentage of the order value. See Order.fees. Will broadcast.

fixed_fees:floatorarray_like- Fixed amount of fees to pay per order. See Order.fixed_fees. Will broadcast.

slippage:floatorarray_like- Slippage in percentage of price. See Order.slippage. Will broadcast.

min_size:floatorarray_like- Minimum size for an order to be accepted. See Order.min_size. Will broadcast.

max_size:floatorarray_like-

Maximum size for an order. See Order.max_size. Will broadcast.

Will be partially filled if exceeded.

size_granularity:floatorarray_like- Granularity of the size. See Order.size_granularity. Will broadcast.

reject_prob:floatorarray_like- Order rejection probability. See Order.reject_prob. Will broadcast.

lock_cash:boolorarray_like- Whether to lock cash when shorting. See Order.lock_cash. Will broadcast.

allow_partial:boolorarray_like-

Whether to allow partial fills. See Order.allow_partial. Will broadcast.

Does not apply when size is

np.inf. raise_reject:boolorarray_like- Whether to raise an exception if order gets rejected. See Order.raise_reject. Will broadcast.

log:boolorarray_like- Whether to log orders. See Order.log. Will broadcast.

val_price:array_likeoffloat-

Asset valuation price. Will broadcast.

- Any

-np.infelement is replaced by the latest valuation price (the previouscloseor the latest known valuation price ifffill_val_price). - Any

np.infelement is replaced by the current order price.

Used at the time of decision making to calculate value of each asset in the group, for example, to convert target value into target amount.

Note

In contrast to Portfolio.from_order_func(), order price is known beforehand (kind of), thus

val_priceis set to the current order price (usingnp.inf) by default. To valuate using previous close, set it in the settings to-np.inf.Note

Make sure to use timestamp for

val_pricethat comes before timestamps of all orders in the group with cash sharing (previousclosefor example), otherwise you're cheating yourself. - Any